Stochastic Trade Valuation

Company

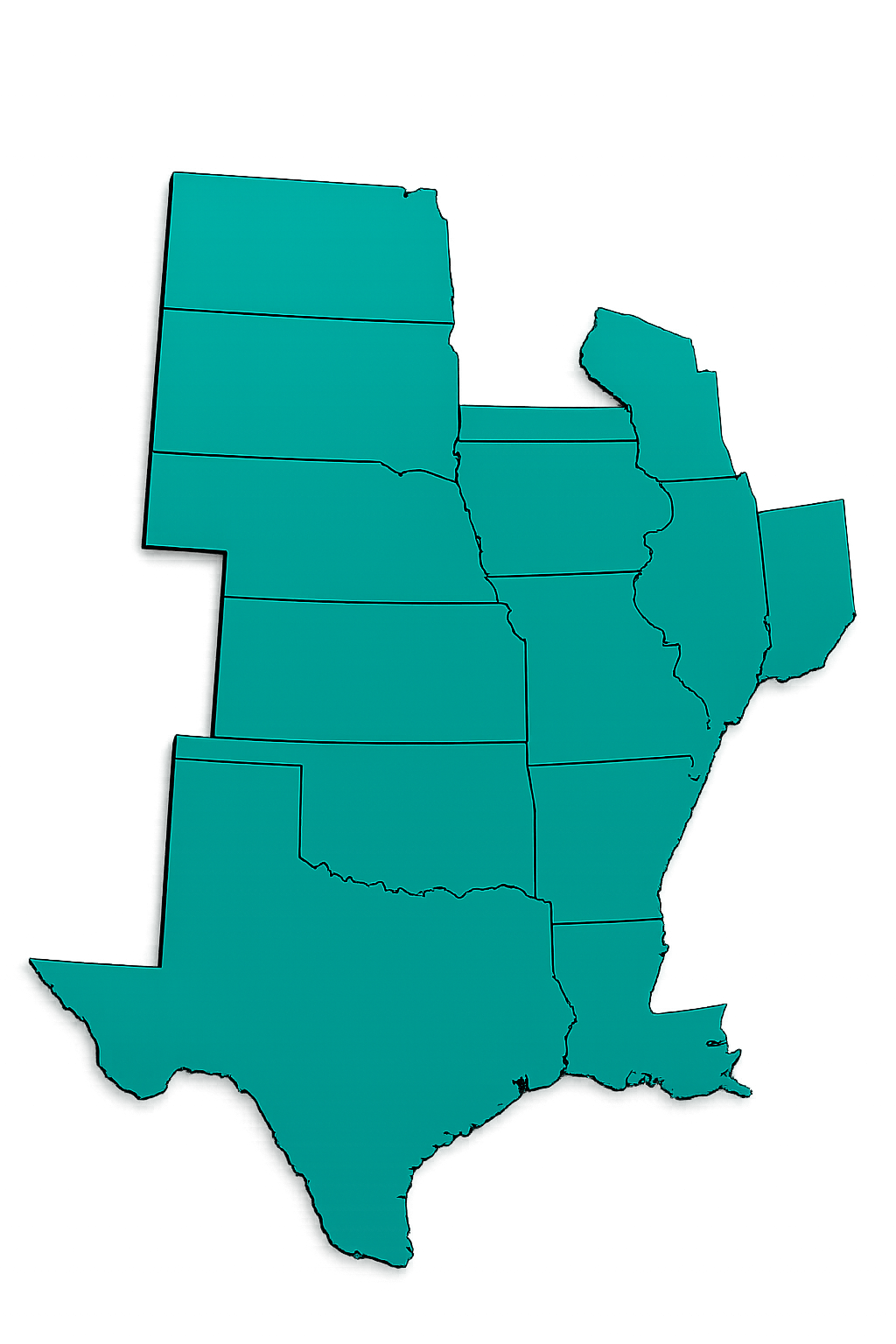

Small company trading power and gas in PJM.

Challenge

Provide straight through processing end-to-end solutions for a small company including pre-trade valuation, trade capture, confirmation, trade monitoring, and risk management.

SATURN

- Provided comprehensive straight-through processing platform and integrated trading workflows.

- Deployed advanced trade valuation with effective risk management and hedging capabilities.

- Streamlined time-consuming market updates, position management, and reporting.

Impact

- Improved pre-trade valuation, post-trade monitoring, and margins forecasting.

- Consolidated critical business management functions onto single platform.

- Generated substantial cost and time savings by eliminating multiple system licenses.